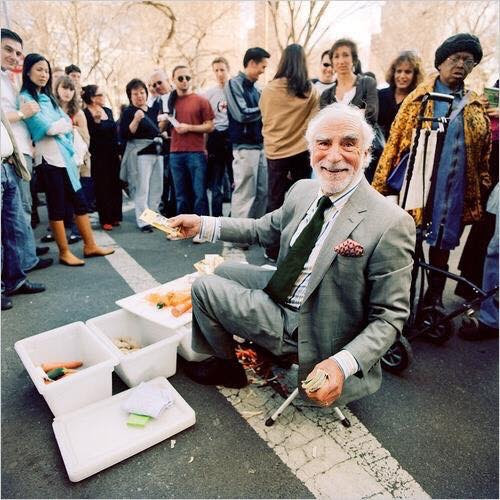

Philip Barker was cutting wood, when a tree top snapped and fell on him. Broke his neck in three places. $70-thousand later, he could work again. But he was bankrupt. Barker already owed half a million dollars. He had bought the family farm a dozen years before. Lost half his cattle herd two years later to disease. Took two more jobs to help pay off the mortgage. Half the Black farmers in North Carolina went out of business during the 1980’s. “In the White community, you can fail a couple of years and still get enough credit to keep going,” Barker points out. “But in the Black community, don’t fail one year or else your credit is ruined, not just for you. Your family too.” His three jobs don’t leave him time to go where deals are made in a small town. Bankers only see him hat in hand. “I don’t have the opportunity to go to the golf course and play golf with my banker on Saturdays. White folks have his ear. I don’t.”

Black Land

by bob.dotson | May 6, 2023 | Blog